Part 2: Government policy on new nuclear stations and energy infrastructure development

2.3 The need for nuclear power

2.3.1 begins “Nuclear power is low carbon, economic, dependable, safe …” Neither of these properties can be fully substantiated

Nuclear’s low carbon property depends on the completion of the entire life cycle, with the possible exception of the “back-end” (assuming the spent fuel remains in dry casks on station sites rather than being placed in an underground repository).

This is because the initial carbon emissions result from the “front-end”, which includes the construction of the reactor and the manufacture of the nuclear fuel. An increasingly significant emission results from the removal of the overburden at the start of an open pit uranium mine.

An Areva EPR weighs around 200,000 tonnes of which 180,000 tonnes is concrete and reinforcing. The alloy steels in the fabrication of the major components and the non-ferrous metals in the controls and instrumentation are all associated with carbon emissions in their manufacture. See EN6_Figure 1 (Areva)

There is also the emissions related to the removal of the waste rock associated with low grade ores. For instance, an EPR has a requirement of 730 tonnes of natural uranium for the manufacture of its initial core charge of fuel. The actual material that has to be removed to extract this uranium, with for instance an ore grade of 0.045% U3O8 (as is the average in Australia), with a characteristic open pit waste rock to ore ratio of 4:1 and a 70% chemical extraction yield, amounts to 730/0.848/0.00045/0.7*5 = 13.7 million tonnes. The removal of the overburden and the subsequent waste rock will require diesel or electrical powered machinery.

See EN6_Figure 2 (Caterpillar)

If a series of new nuclear power plants are built over say the ten years following the licensing by HSE/NII, the successive emissions from the construction of the fleet and the mining of the uranium for the initial core charges will only be compensated by the subsequent low carbon operation if it endures for the remainder of the life-cycle. The average operational life of NPPs now shut down is 22 years, so as the life cycle calculations are calculated against the 40 to 60 years claimed life, the full benefits may ever be realised. Also towards the end of the century, the remaining uranium ore grades will decline, increasing dramatically the input energy to the cycle.

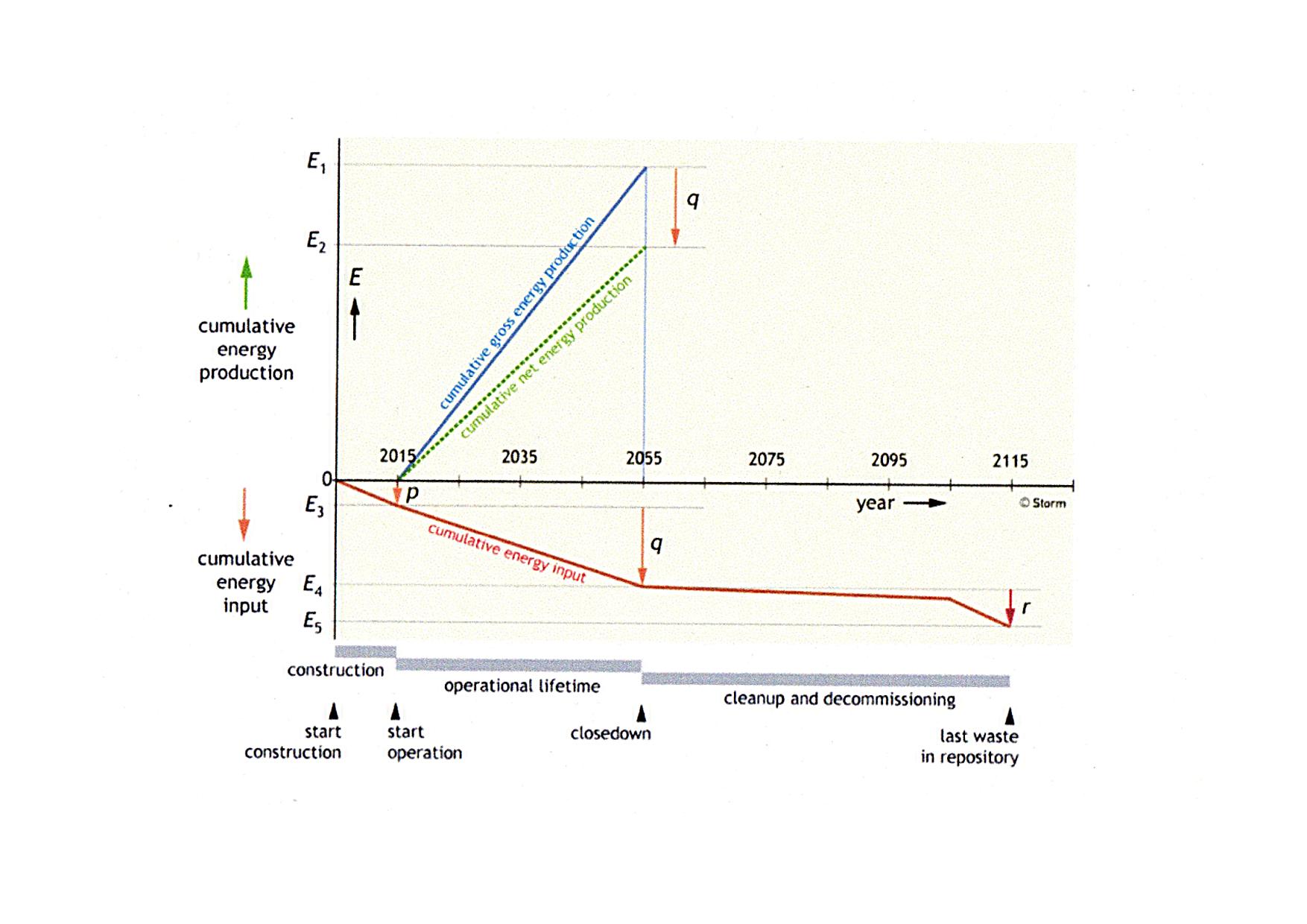

See EN6_Figure 3 for a 5 year construction period and 40 year operational life (Storm van Leeuwen).

The claimed low carbon property of nuclear power is

dependent on too many imponderable factors to be assured.

The first EPR is proving to be far from economic, mainly because of delays in its construction. The Olkiluoto contract was signed in 2003 and the EPR may not be commissioned until 2013. In a fixed price contract it is normal for a down-payment to be made, followed by progress payments to be made at certain achieved stages in the programme. A construction period of double the assumed time means that the preceding cash flow calculations are invalid and a return on the increased capital expenditure may be delayed or never achieved.

The price of the next EPR will depend on the outcome of Olkiluoto, which may take several years to establish as both parties, Areva and TVO, are engaged in litigation and counter claims.

The other factor is the ageing of the major components of which so far around 200 reactor vessel heads and steam generators have had to be exchanged, the life of them has up until now been 15 to 20 years. Alternative alloys are now utilised, but the duration of these is uncertain as with ageing only time can tell. The exchange of the major components has been masked by naming it “upgrading” instead of “maintenance”.

As the construction of the plant and the manufacture of the

fuel is associated with carbon emissions, the levying of a carbon tax on the

suppliers will also lead to increased costs. The alloy components, such as

nickel, chromium and steel are all dependent on the mining of ores of a

decreasing grade. Also copper and other metals in the control and

instrumentation are subject to price rises. It is inevitable that the next

contracts, if negotiated at a fixed price, will be subject to variations based

on component prices. It would be a brave trader offering fixed future commodity

prices over a perhaps ten years contractual period.

The economic analysis in the successive White Papers is therefore out of date and a revision may prove impossible to conduct. The level of subsidy required by the generator will therefore be equally impossible to assess.

British Energy is currently around 70% owned by the French state, but half of the French fleet has to be replaced or upgraded in the next ten years, so unless the UK government passes some funds to the French government, the as yet undefined costs of the UK EPR fleet will not be found, especially as both EdF and Areva have huge debts. The regulators on both sides of the Channel are reluctant to allow tariffs to rise to generate the capital needed.

Without a generous subsidy from the British government to the generators, such as British Energy, RWE or E.On or in the case of EdF an undisclosed payment to the French state there will be no new build in the UK.

The security of supply depends entirely on a 100% imported fuel manufactured from natural uranium. Primary mining provides only round 60% to 70% of the demand, the remainder coming from uncertain secondary sources, due to come into a state of flux after 2013. The Megatons to Megawatts US/Russian deal will be replaced by an ability to market uranium in the US and some supply deals have been forged.

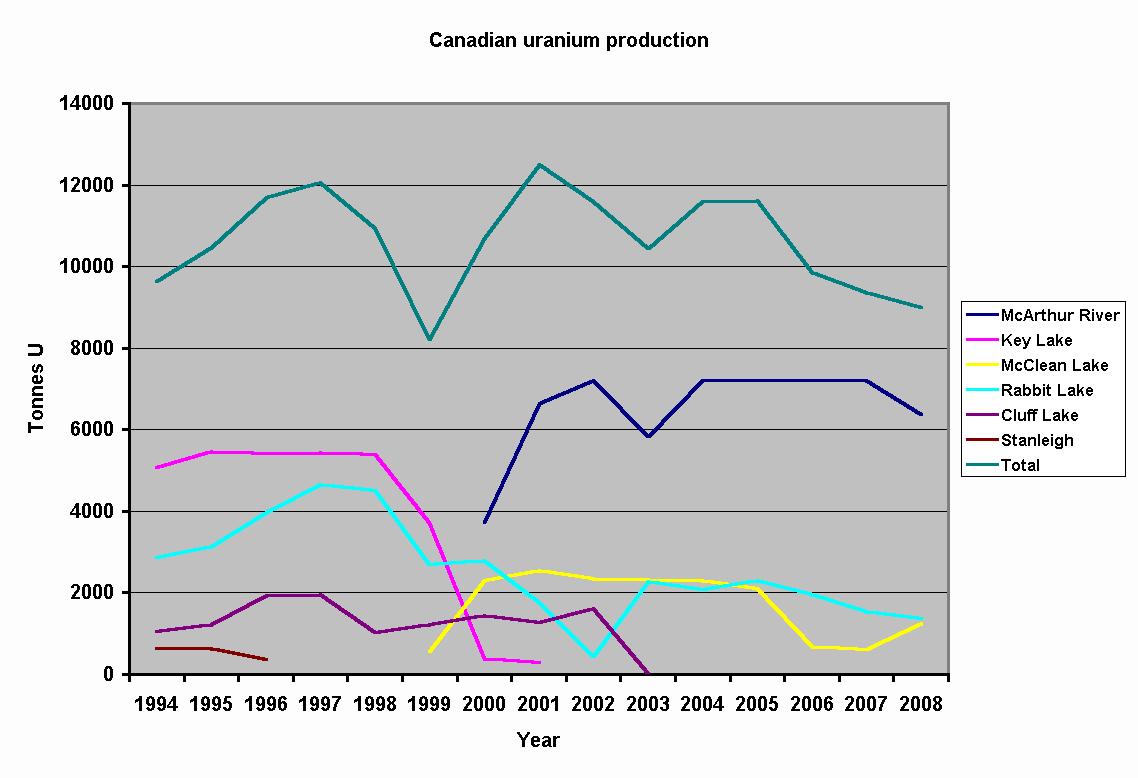

Russian mining and demand is in parity, but much is promised to China, India, Korea and Japan, so as Canadian uranium mining is in severe decline, the end of the ex-weapons deal means that the US and France will be in competition for limited supplies.

See EN6_Figure 4 which plots individual Canadian uranium mines’ production showing its progressive decline.

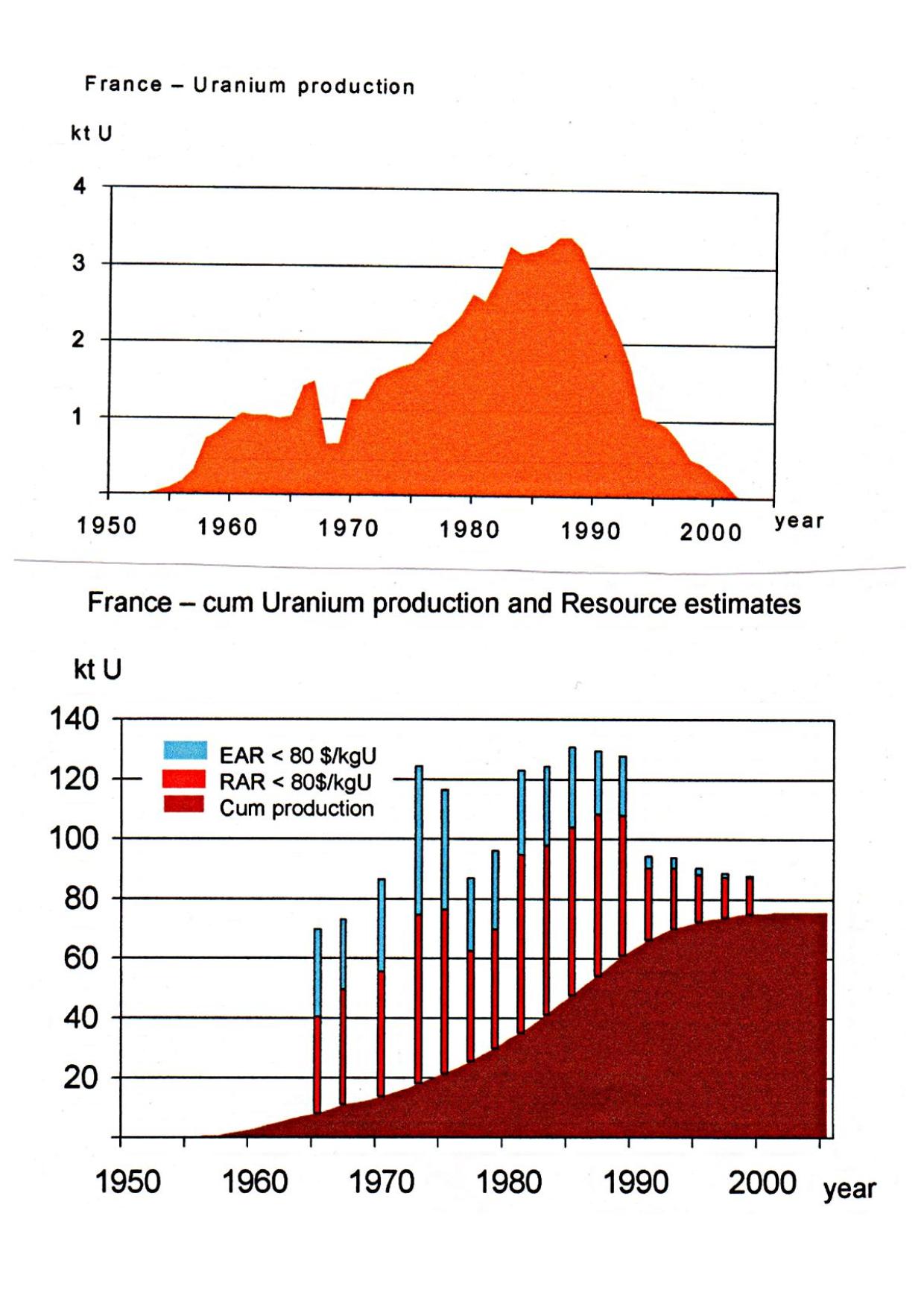

France supplies Sizewell B with its fuel and with its own needs and that of its nuclear hegemony imports 13,000 tonnes a year from around 43,000 tonnes of primary mining, so that the withdrawal of the equivalent of 10,000 tonnes from the fuel market, will perhaps lead to some of the lights going out in France, which is over dependent on nuclear (76%) and where its indigenous mines are exhausted.

Areva will have to find 730 tonnes of uranium for the manufacture of the initial core charge for Olkiluoto and for Flamanville.

Australian mining is in a less rapid decline but is also promising supplies of uranium to China, which in turn is becoming increasingly nervous as to its supplies for its burgeoning fleet. The Areva supply contract for two EPRs for China is tied to the successful opening of Areva’s Trekkopje mine in Namibia, 35% of which is promised to China. Kazakhstan was due to rapidly expand, but the Kazakh government has now announced that this is to be restricted. In any case its output has been forward sold to China, Russia, Korea and Japan.

The problem is that individual mines, like oil wells, follow a Hubbert curve of build-up, plateau and decline of output, so that to maintain national production a series of new mines needs to be opened. If nuclear power is to be doubled or tripled, then a succession of even more mines are needed. In Canada the Cigar Lake mine is flooded and may never open , while in Australia the Olympic Dam expansion will not open until 2018, if ever, after 2 billion tonnes of overburden are removed to reach the first ores below 300 metres of rock.

The huge building programme in China alone will mop up any

surplus uranium and with the demands of new build in Russia, Korea and Japan a

lack of supplies to the West can be anticipated. The optimistic forecast of the

OECD/NEA “Red book” can be set aside when the experience in France is

analysed. As the French mines approached their closure, the predicted

“resources” were progressively reduced to zero.

See EN6_Figure 5 for the plots (EWG)

Nuclear power in the UK cannot depend on its fuel supplies.

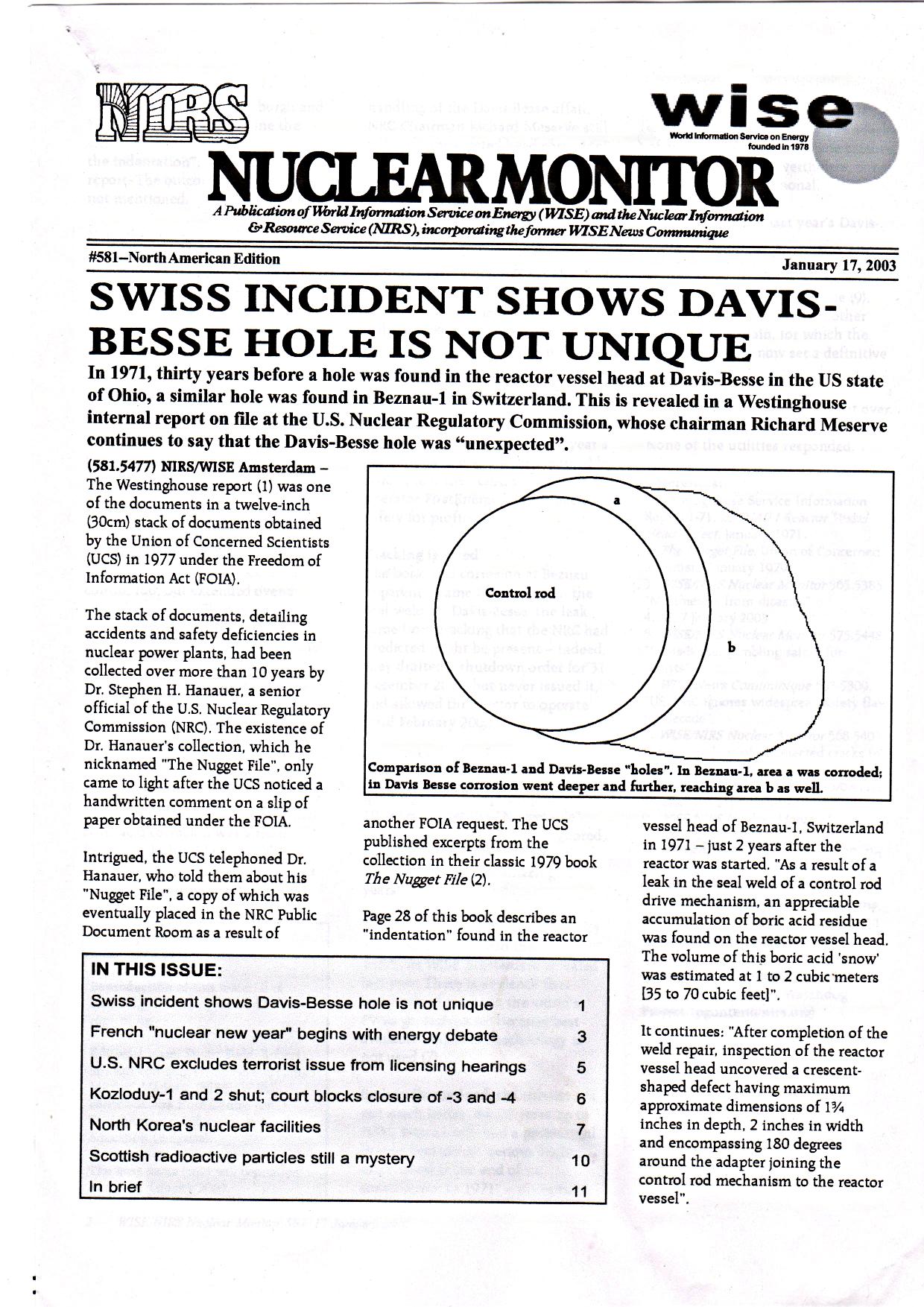

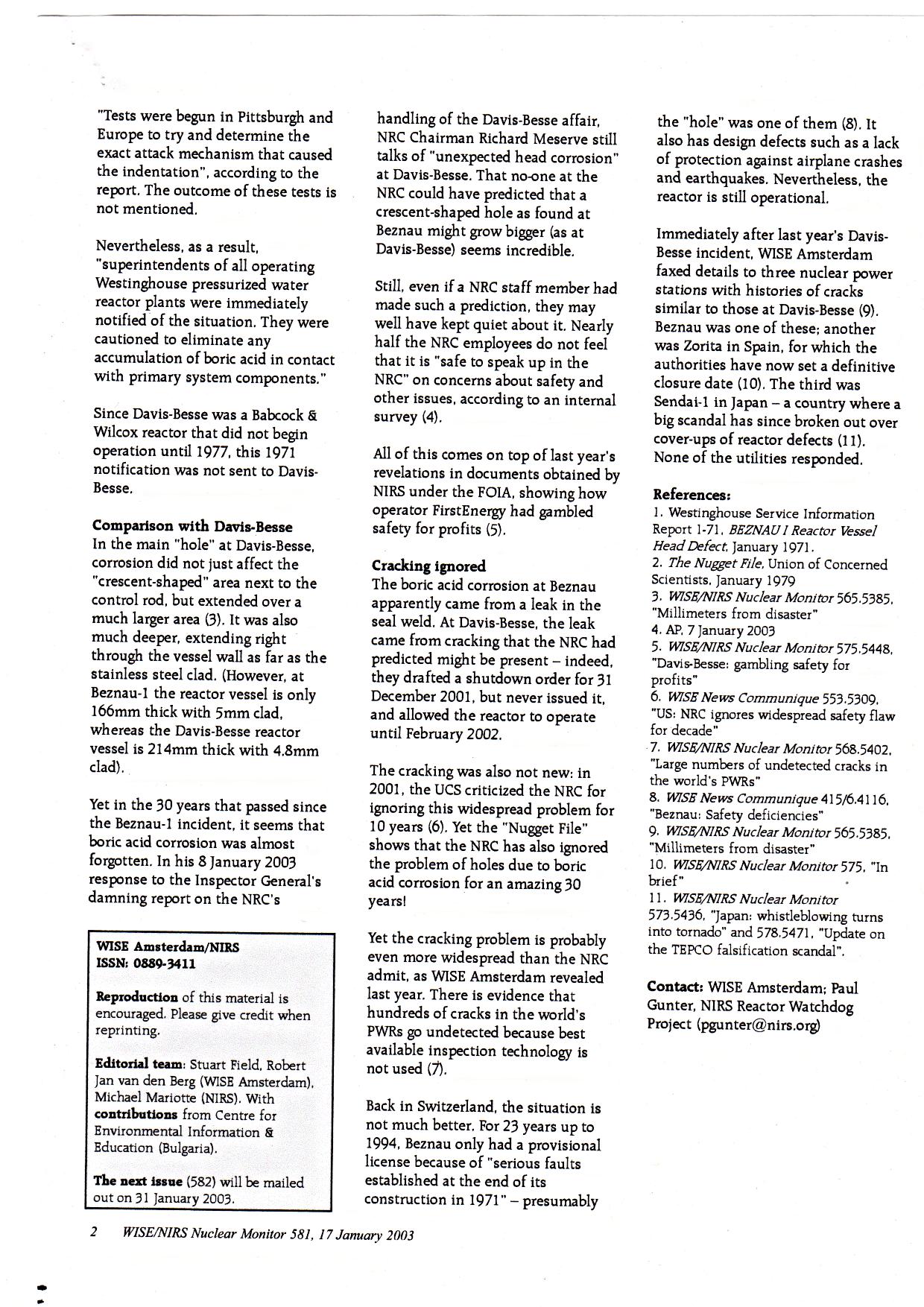

In 1971 a hole appeared in the Swiss Beznau-1 reactor vessel head after just two years of operation. A leak in a weld allowed boric acid, added to the cooling water as a neutron absorber, to attack the ferritic outer shell. This incident did not emerge until a much bigger hole appeared in the Ohio Davis-Besse reactor vessel head in 2002, some thirty years later.

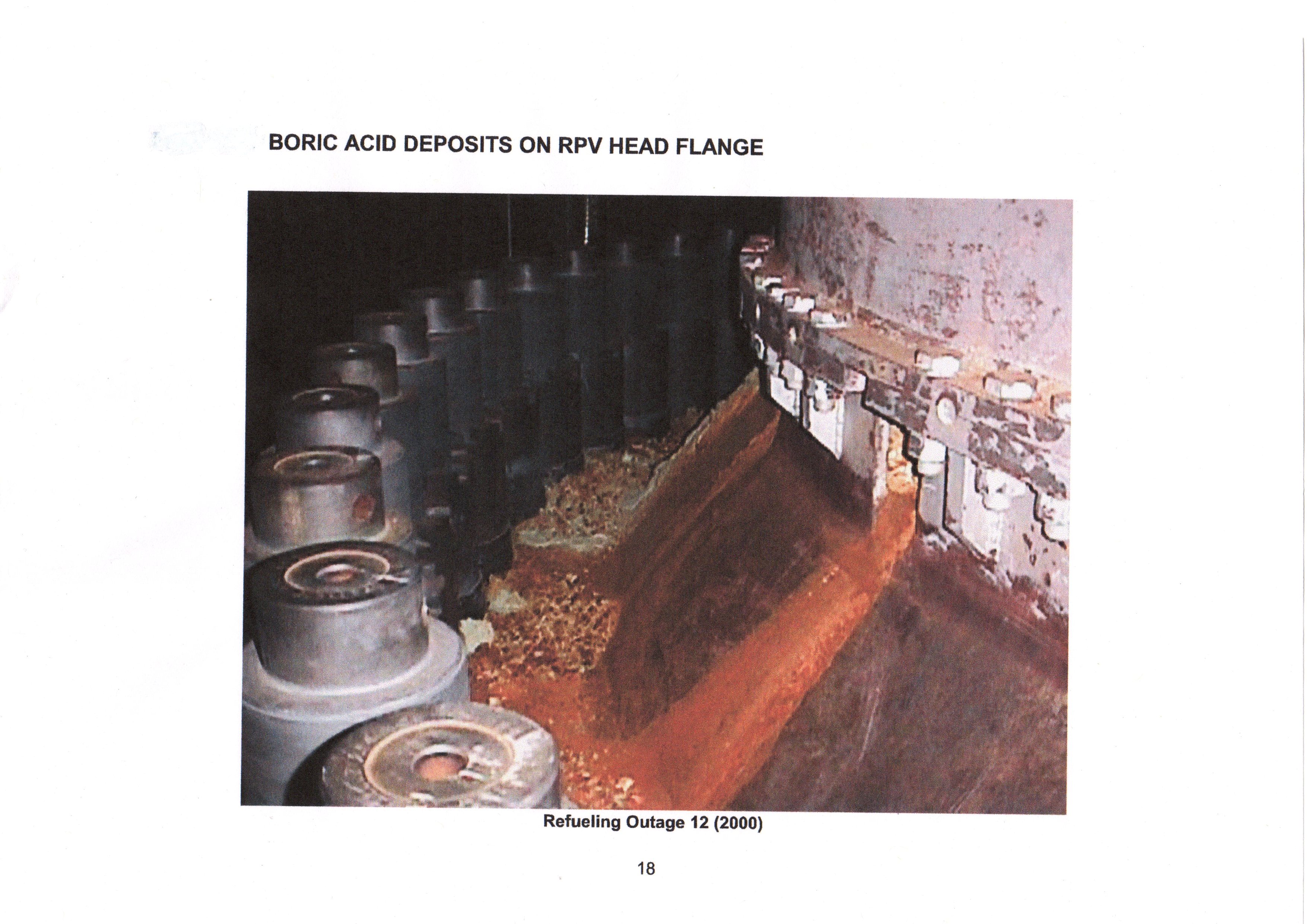

At Davis-Besse the acid ate away at the thick outer shell, the pressure being held by the thin stainless steel liner. Although the liner was subject to cracking, the initial leak came from a crack in a “penetration” tube of Inconel 600 alloy steel into which a control rod is dropped. When major components are replaced, such as reactor vessel heads and steam generators, Inconel 690 is substituted, which has a higher chromium content and is considered to be more crack resistant, though some samples have exhibited cracking. The management of Davis-Besse were fined because of lax procedures, which could have led to a loss of cooling catastrophe, had the cracks in the liner led to a rupture of the vessel.

See EN6_Figure 6a and EN6_Figure 6b (NIRS Wise)

See also EN6_Figure 7a, EN6_Figure 7b and EN6_Figure 7c for details of the hole in the Davis-Besse reactor vessel head and the cracks in the stainless steel liner.

(US Nuclear Regulatory Commission)

Tritium is produced by the neutron bombardment of boron,

which then enters the grain structure of the vessel liners and generator tubes,

resulting in intergranular stress corrosion cracking. This also leads to leaks

in spent fuel pond liners, as boric acid is also added to the pond water as a

neutron absorber. Also the irradiation of the enclosures leads to metal

embrittlement.

The industry has introduced an ageing management practice, with internal monitoring specimens and in the case of the EPR reactor vessel a heavy stainless steel reflector surrounds the core. Its claims of a 60 year operational life are subject to regular 10 year inspections and component exchange when shown to be necessary.

During the build-up phase of new build, the construction and mining activities will add considerably to carbon emissions. Only after 40 to 60 years in retrospect can a nuclear power plant be considered to be low carbon

The delays in the construction of the Olkiluoto EPR have

shown new build to be uneconomic, especially highlighting the lack of skilled

manufacturing resources.

The decline of primary mining production in Canada and Australia and the failure to open new mines of a significant size shows that uranium supplies are not dependable. The diluted ex-weapons fuel needs considerable tails enrichment facilities predominantly owned by the Russians and likely to be offered more widely to its nuclear hegemony.

From the moment the fission initiates, the metal enclosures are subject to irradiation attack and the ageing process begins. Safety depends on adequate monitoring of the ageing process over the 60 years operational life of the new build reactors and experience shows that this cannot be guaranteed

The so-called nuclear “renaissance” has been instigated by a successful PR campaign and adopted by governments based on false claims of its low carbon nature, economic generation, dependability and safety. .

John Busby 28 December 2009