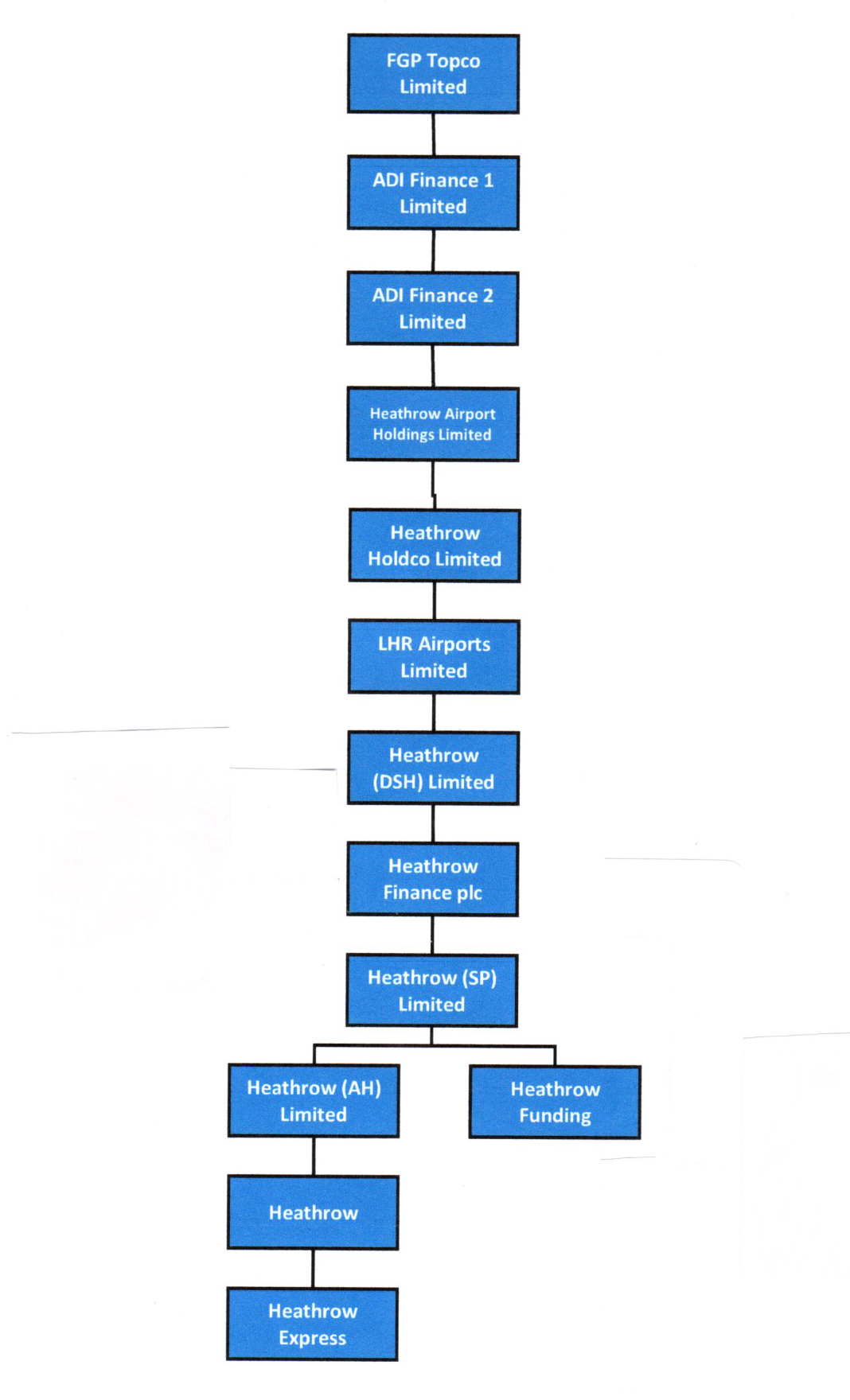

Heathrow's Group Structure

Heathrow airport has a group structure comprising a top company, FGP Topco Limited and 12 main subsidiaries including four finance companies, one of which is offshore and the eleventh below the top company, Heathrow Airport Limited holds the operational licence of CAA. See statement from FGP Topco's 2018 annual report:-

Note 11 Ultimate parent undertaking and controlling party. The Company is the ultimate parent entity and the parent undertaking of the smallest and largest group to consolidate these financial statements.

The shareholders of FGP Topco Limited are Hubco Netherlands B.V. (25.00%) (an indirect subsidiary of Ferrovial, S.A., Spain), Qatar Holding Aviation (20.00%) (a wholly-owned subsidiary of Qatar Holding LLC), Caisse de depot et placement du Quebec (12.62%), Baker Street Investment Pte Ltd (11.20%) (an investment vehicle of GIC), Alinda Airports UK L.P. (11.18%) (an investment vehicle managed by Alinda Capital Partners), Stable Investment Corporation (10.00%) (an investment vehicle of the China Investment Corporation) and USS Buzzard Limited (10.00%) (wholly-owned by the Universities Superannuation Scheme).

Figure 1 Heathrow's Group Structure

Heathrow Holdco Limited holds a number of smaller subsidiaries. Heathrow Funding Limited is registered in Jersey. The annual reports of all the UK companies are available in Companies House, while that of Heathrow Funding Limited is available in Heathrow's Investor Centre.

Basis of consolidation, from FGP Topco's annual report 2018

The Group financial statements consolidate the financial statements of FGP Topco Limited and all its subsidiaries.

Subsidiaries

Subsidiaries are consolidated from the date of their acquisition, being the date on which the Group obtains control, and continue to be consolidated until the date that such control ceases. Control is defined as where the Group is exposed or has rights to variable returns from its involvement with the subsidiary and the ability to affect those returns through its power over the subsidiary.

Intra-group balances and transactions are eliminated during the consolidation process.

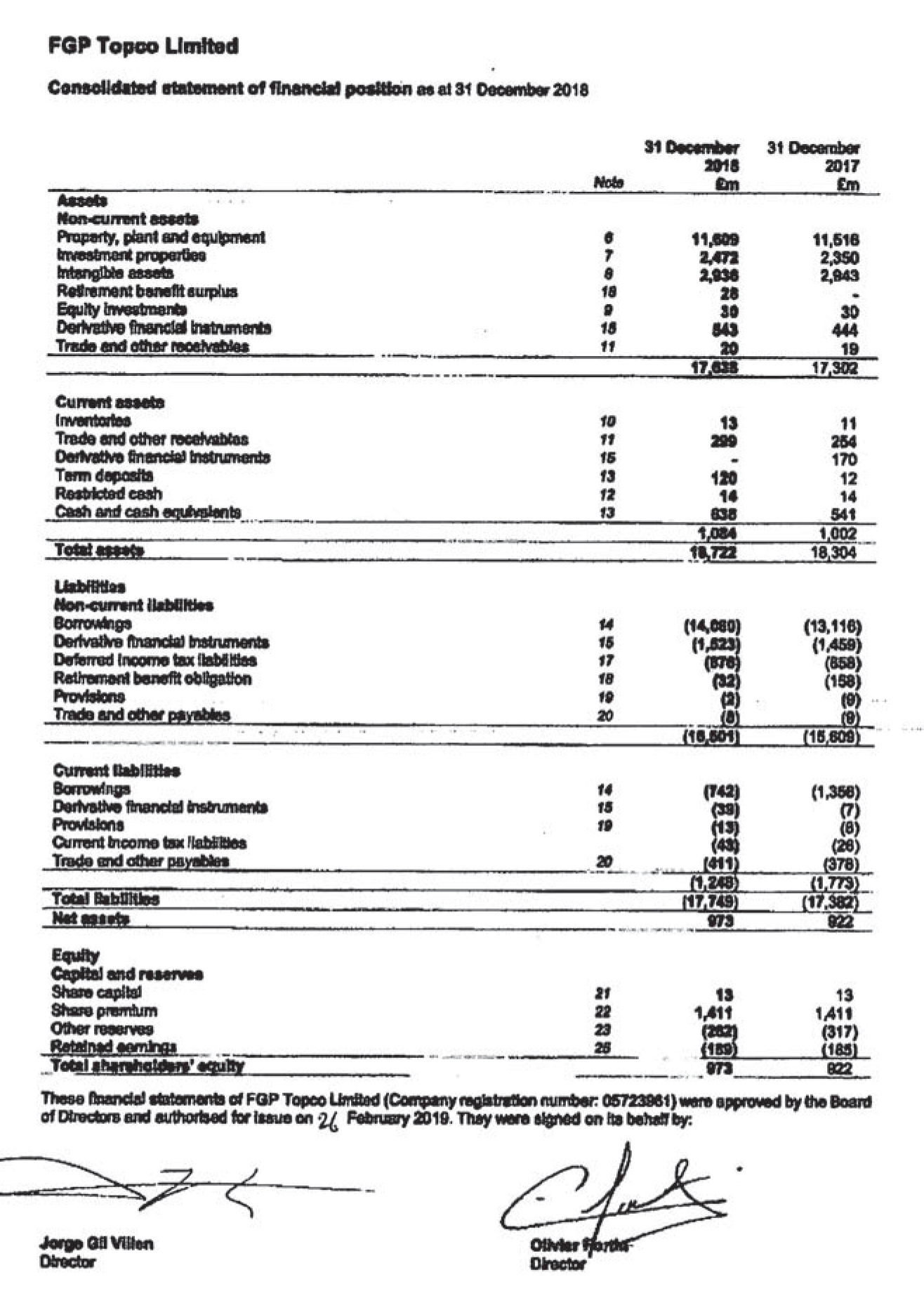

Figure 2 Heathrow's financial position from page 35 of FGP Topco's 2018 annual report

Equity

The equity comprises the original paid up shares of £13 million, a share premium of £1, 411 million presumably established from the price paid for Ferrovial's 37% shareholding when sold, minus negative "Other reserves" and "Retained earnings" In a liquidation the shares would have no value, there would be no net assets, so the top company is described as a "going concern" and its position is a net current liability

Going concern from page 38 of FGP Topco's 2018 annual report

The directors .have prepared the financial statements on a going concern basis which requires the directors to have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future.

Consequently the directors have reviewed the cash flow projections of the Group taking into account:

Whilst the Group is in a net current liability position, as a result of the review, and having made appropriate enquiries of management, the directors have a reasonable expectation that sufficient funds will be available to meet the Group's funding requirement for the twelve months following the date when the Statement of financial position was signed..

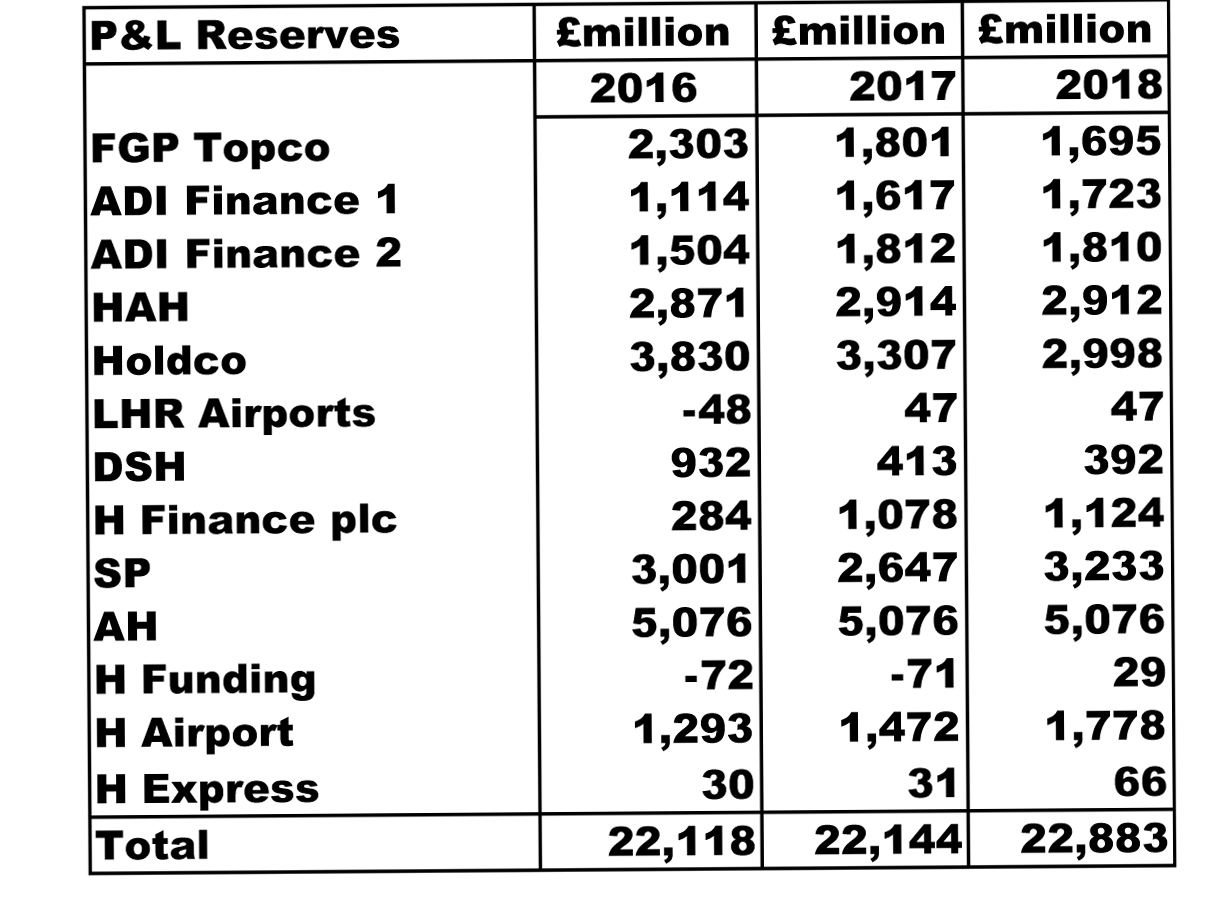

Profit and loss reserves

In the consolidated statement of its financial position in Figure 2, no entry is made for the Profit and Loss reserves given as £1,695 million in Note 7 on page 92 of FGP Topco's annual report 2018. Moreover, each of the other 12 main companies in the group has a P&L Reserves. The aggregate of these is £22,883 milllion as show in Figure 3.

Figure 3

The P&L reserves in the main subsidiaries over three years have been totaled, the aggregate of which is £22.883 million. If this sum exists, presumably it would be consolidated into the financial position in Figure 2.

Figure 4

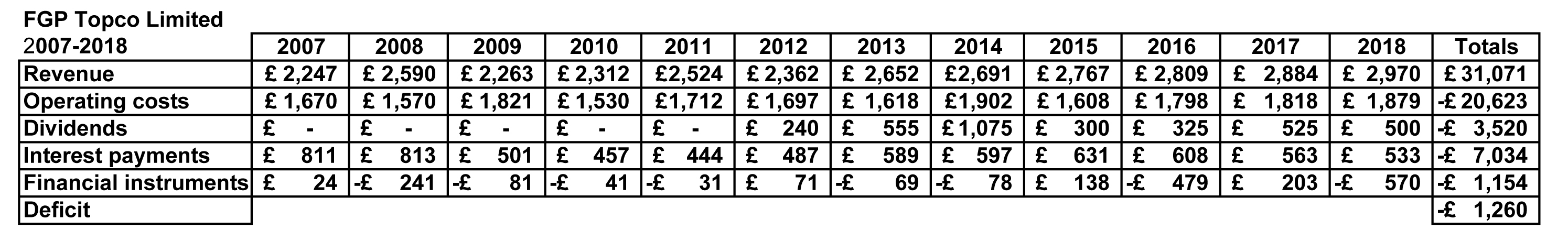

In order to define the origin of the P&L reserves the principle results of FGP Topco over its existence from 2007 to 2018 have been tabulated.

Over the 11 years of FGP Topco, it has accumulated a deficit of £1,260 million by which its initial borrowings in 2007 of ca. £13 billion have increased by the deficit to ca. £14 billion in 2018. If the total of the P&L Reserves is spread over the 13 companies does exist, from where does it originate?

Purpose of this analysis

Heathrow's 156 set of annual reports is complex and repetitive. It is a formidable task to analyse. It's disquieting to observe the construction of the accounts leads to the formation of tax credits, while the prospectuses obviate the payment of withholding tax on the interest.

If this sum does exist, then the borrowings could be redeemed, profits created and subjected to corporation tax.

It will be circulated to the government agencies concerned, in the hope that an explanation will arise of the true financial state of an airport about to expand its facilities - before it initiates a task beyond its capabilities.

John Busby 27 September 2019