Plenty of oil?

In September 2006 Business Week quoted Cambridge (Massachusetts) Energy Research Associates (CERA)’s director Robert W. Esser saying: “Peak Oil theory is garbage as far as we’re concerned.” (1) The comment was occasioned by the discovery by Chevron (jointly with Devon Energy and Statoil) of oil in a well named Jack 2 some 280 km (175 miles) off the Louisiana coast in 2134 m (7,042 ft) of water and 8590 m (28,175 ft) below the ocean floor of the Gulf of Mexico. The estimated oil reserves range between 3 and 15 billion barrels.

Since then oil has been discovered off Brasil under a layer

of salt. Oil deposits above the salt layer are called post-salt, while those

below are called pre-salt. (2) A pre-salt reservoir has been discovered 290 km

South of Rio de Janeiro in the Tupi area. The water depth is around 2,200 metres

(7,000 ft) below which the salt layer is some 2,000 metres thick. The drilling

depth is therefore over 4,200 metres (14,000 ft.) while drilling to 6,000 metres

(20,000 ft) is now possible.

The recoverable volume of light oil and natural gas is estimated to be between 5 to 8 billion barrels oil equivalent. The oil is light (28° API) and contains 8-18% CO2.

A semi-submersible rig is composed of horizontal underwater

pontoons supporting vertical columns on top of which is the drilling platform.

It is used in deep waters where an immobile platform resting on the sea bed or a

jack-up rig lifted over the water with long leg structures would be impractical.

In the shallower waters it can be moored with a set of anchors, but in deeper

waters it is initially held in a GPS position by a number of thrusters. (2). The

drill pipe goes through a blowout preventer (BOP), resting on the sea bed.

The use of thrusters rather than moorings, means in the

event of a hurricane, the drill pipe can be lifted from the BOP and the rig

moved to safety. Also the depth of the waters makes mooring a complex and

expensive task. Multiple catenary chains or wire ropes are run out in four

directions and have to be spread over a large seabed area to achieve stability.

Fibre ropes are used for taut leg systems which greatly reduce the sea floor

footprint.

The world was made aware of one famous semi-submersible,

Thunder Horse, which in July 2005 suffered from Hurricane Dennis in the Gulf of

Mexico ending up listing heavily. It was commissioned after repairs three years

later in June 2008 and operates at around 70% of its design capacity of 290, 000

barrels of oil equivalent of oil and gas per day. BP claims it is the largest

semi-submersible in the world and it has a displacement of 130,000 tonnes. (3)

The Chevron Jack 2 discovery was made using the ‘Cajun

Explorer’ semi-submersible, a huge structure able to house 150 workers, (4)

but small compared with the drillships used off Brasil.(5).

Transocean used its ultra-deepwater semi-submersible rig 'Deepwater Horizon' to drill the deepest well up until now while working for BP and its co-owners on the Tiber well in the US Gulf of Mexico. Transocean drilled to 10,680 m (35,050 ft) depth or more than six miles, while operating in 1,260m (4,130 ft) of water. Deepwater Horizon is a dynamically positioned ultra-deepwater semi-submersible rig capable of working in water depths of up to 10,000 feet (3,000 m).

Typical semi-submersible

Semi-submersibles have played a role in the Brasilian

Santos Basin off Rio de Janeiro, but a recent Brasilian discovery ‘Azulao-1’

was made using the drillship, ‘West Polaris’. For its specification see (6)

and to view an example see (7). It can work in a maximum water depth of 3,050

metres and to a maximum drilling

depth of 11,430 metres. Like the semi-submersible a drillship relies on

thrusters to maintain its position. It has quarters for 180 staff.

Typical drillship

Petroleo Brasiliero SA, owner of the discoveries, plans to order 40 drillships , each vessel costing around $750 million. The Petrobras presentation provides a long list of the technological challenges, while claiming the ultimate recovered oil at 5 to 8 billion barrels, but it gives no estimate of the overall cost of the venture.

See Petrobras’s presentation (8).

Having discovered the oil and gas, the semi-submersible or

drillship provides the initial means of well test production. For extended well

tests a dynamically positioning floating production, storage and offloading

vessel (DP FPSO) using thrusters is used.

During the extended well test the extracted oil is

transferred from the DP FPSO to a series of shuttle tankers to bring it ashore.

This is then replaced by a moored floating production, storage and offloading

vessel (FPSO). FPSOs are

particularly effective in remote or deepwater locations where seabed pipelines

are impractical and eliminate the need to lay long-distance pipelines from the

wells to an onshore terminal.

Typical FPSO

The gas from the initial oil is flared. To recover the gas,

the FPSO would have to be equipped with a separation plant, which also removes

the CO2 and cleans the gas of contaminants before it goes to a

liquefaction plant to produce LNG suitable for shipment in a series of shuttle

gas tankships. Otherwise the output from the separation plant has to be

transferred to shore by a sub-sea pipeline, which in the case of the Tupi field

is a 220 km long 460 mm diameter pipe (18”) laid in a water depth of 2,200

metres.

Once replaced by the DP FPSO the drillship can be released to perform further prospecting tasks, but 40 drillships are on order, so it must be assumed that some initial production will rely on them. If a gas pipeline is not to be constructed, then perhaps the succeeding FPSOs would be even bigger from the outset to accommodate a gas purification and liquefaction plant for LNG production in order to avoid flaring from the outset. Shell has proposed an LNG-FPSO to produce 3.5 million tonnes of LNG a year, but it appears that the Petrobras FPSOs will have compression facilities for gas and CO2 for re-injection into the wells.

The first successful well cost $240 million to locate, so

with the cost of the drillship it required an initial investment of at least $1

billion. To release the drillship for further exploration then requires the

deployment of the DP FPSO, then the moored FPSO. The subsequent costs of

drilling a cluster of production wells, connecting them to the riser pipe

strings, providing at least two shuttle tankers to serve the FPSO, can only be

imagined.

The subsea equipment is complex and needs to be served by remotely operated underwater vessels (ROVs).

Typical ROV

Jack 2

In 2006 ASPO-USA’ “Peak oil Review” (9) reviewed the

Jack 2 discovery just after it was announced. It suggested that production would

not result until 2012 to 2014, six years later. This comment is justified as

Chevron started production in its Blind Faith field, also in the Gulf of Mexico,

in 2008, seven years after its discovery in 2001.

Brasil’s oil

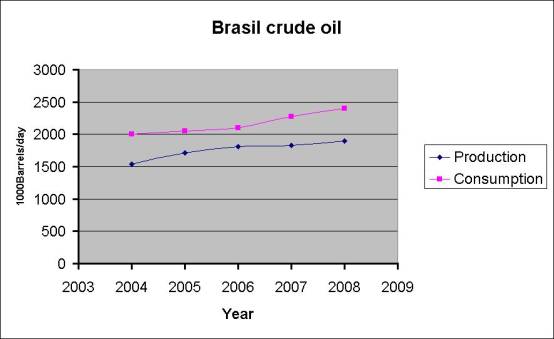

Figures taken from BP’s Statistical Review 2009 show that

Brasil’s crude oil domestic consumption is rising faster than its production

is rising.(10)

The new production from the Tupi field will be needed to resolve the internal deficit problem and allow little to be exported. Over the next ten years, taking into account the likely fall in the present national production and extrapolating the internal demand, Brasil will require some 2.5 billion barrels of crude oil for its own use, around half of the estimated Tupi field content.

So even if this massive project is funded, it offers no alleviation of the global peak oil problem. In addition another tranche of oil will be needed to fuel the construction of the drillships and FPSOs, to fuel the positional thrusters and the shuttle tankers, to maintain the welfare of thousands of tool-pushers and to manufacture the ancillary materials, including thousands of pipe sections and tonnes of blowout preventing mud.

Contribution to global oil demand

The current annual world crude oil demand is around 30 Gb (billion barrels) so that the entire Tupi reserves of 5 to 8 billion barrels would last for a mere 2 to 4 months. From this should be subtracted the oil products consumed during the exploration and development phases.

After the discovery of Jack 2, CERA was quick to claim that peak oil is “garbage”. Yet in regard to the Tiber discovery in the Gulf of Mexico it commented that - "it is likely to be in the order of 10 years before the first oil flows."

To establish the veracity of its statement CERA should now calculate the specific energy input per barrel of presalt oil equivalent and what proportion of a barrel extracted this represents. It is quite likely that the sum of the crude oil consumed in providing the oil products deployed in the overall project may exceed the amount of crude oil produced therefrom.

Otherwise it is normal to calculate the overall project cost of

extracting a barrel of oil and compare it with the market price.

A thorough analysis of the Jack 2 and Tupi fields’ prospects will be a

daunting task, but unless it is prepared to make an effort to establish the

viability of subsea production with a clarity able to be checked, its own

statement is “garbage”.

© John Busby 3 September 2009

1. http://www.businessweek.com/magazine/content/06_38/b4001055.htm

2. http://www.rigjobs.co.uk/oil/oilrigs.shtml

3. http://www.bp.com/genericarticle.do?categoryId=9013613&contentId=7021462

4. http://www.wired.com/cars/energy/magazine/15-09/mf_jackrig?currentPage=all

5. http://www.ship-technology.com/projects/discoverer/

7. http://www.mitsui.co.jp/en/release/2009/__icsFiles/afieldfile/2009/06/16/en_090616_01.pdf

8. http://www2.petrobras.com.br/ri/pdf/2007_Formigli_Miami_pre-sal.pdf

9. http://www.peakoil.org.au/news/debunking_the_hype_over_the_jack-2_discovery.htm