In

1991 Senator Jesse Helms told Boris Yeltsin that the KAL-007 tragedy was

one of the most tense incidents in the entire Cold War. Sakhalin is now

the bridgehead of a new cold war in a squabble over ownership of its oil

and gas reserves.

In

1991 Senator Jesse Helms told Boris Yeltsin that the KAL-007 tragedy was

one of the most tense incidents in the entire Cold War. Sakhalin is now

the bridgehead of a new cold war in a squabble over ownership of its oil

and gas reserves.

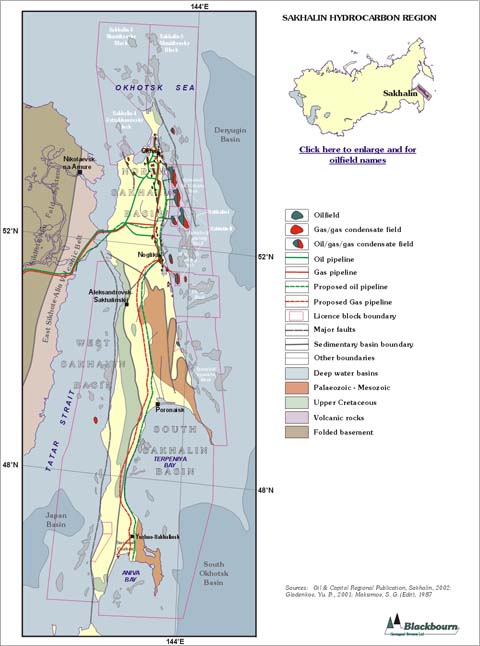

Sakhalin is an island, owned by the Russian Federation, in the Sea of Okhotsk, separated from the Eastern coast of Russia by the Tatar Strait and from Japan by La Pérouse Strait. The island is some 965 km long from North to South and the width varies from around 24 km to 160 km. It achieved notoriety in 1983 when Korean Air Flight 007 strayed off its flight path over it and was shot down by a Russian fighter, killing all on board including US Congressman Lawrence McDonald.

In 1991 Senator Jesse Helms told Boris Yeltsin that the KAL-007 tragedy was "one of the most tense incidents in the entire Cold War". Sakhalin is now the bridgehead of a new cold war in a squabble over ownership of its oil and gas reserves.

click on picture for larger image

Oil and gas reservoirs occur off the North-Eastern shore and two major international projects are underway to exploit the reserves, known as Sakhalin 1 and Sakhalin 2.

Units

|

'Owned' gas reserves are rising due to acquisitions and joint ventures while oil reserves are declining. So the "booked" reserves are given as the combined figures, allowing claims of reserve replacement to be made, thus obscuring the decline in the oil reserves.

Sakhalin 1

To the North of the island and off its East shore are three oil and gas fields, Chayvo, Odoptu and Arkutun Dagi, with potential recoverable resources of 2.3 Gb (gigabarrels or billion barrels) and 485 bcm (billion cubic metres) or 3.05 Gboe of natural gas. A multi-national consortium was formed to exploit these consisting of US Exxon/Mobil (30%), Japanese SODECO (30%), Indian ONGC Videsh (20%) and Russian state-owned Rosneft (20%).

From 2005, natural gas has been delivered to local markets in the Khabarovsk region on the mainland. An onshore processing facility is about to be commissioned which will separate the oil from the gas. The oil will be delivered to an export terminal on the mainland via a 226 km pipeline which crosses the island in a Westerly direction and the Tatar Strait, then heading South-West along the coast.

Sakhalin 1 is expected to produce 250,000 barrels of oil per day (0.091 Gb/annum) and 7.65 mcm (million cubic metres) of gas per day, i.e. 2.8 bcm per annum, to local consumers by the end of 2006. The project is expected to cost the consortium US$17 billion.

Sakhalin 2

The second Sakhalin project is conceived to exploit two further oil and gas fields, Piltun and Lunskoye with potential recoverable resources of 1 Gb of oil and 500 bcm of natural gas (or 3.1 Gboe), also off the North-East coast of the island. A further multi-national consortium was formed with current shareholders British/Dutch Royal Dutch Shell (55%) and Japanese Mitsui (25%) and Mitsubishi (20%).

Oil and associated gas from Piltun and gas and condensates from Lunskoye will be separated into oil and gas at an offshore processing facility prior to pipeline transmission. Two pipelines will then transport the oil and gas to Aniva Bay, Prigdorodnoye 800 km South of the reservoirs on the Southern end of the island, the oil to an export terminal and the gas to a liquefied natural gas (LNG) plant, also for export.

The reason for the long overland pipelines is to ensure export can be maintained in the winter months when the sea around the Northern part of the island freezes over.

Sakhalin 2 is expected to produce 60,000 barrels of oil per day (0.022 Gb/annum) and 51 mcm of gas per day (18.6 bcm/annum) by the end of 2006. The liquefaction plant is expected to export 9.6 million tonnes of LNG per annum, discharging from a terminal into a fleet of LNG tankships. The project is expected to cost the consortium US$20 billion.

Global significance

World consumption in 2005 was 30 Gb of oil and 2,763 bcm, or 17 Gboe (gigabarrels oil equivalent) of natural gas. The combined oil reserves of Sakhalin 1 and 2 total 3.3 Gb, while the combined gas reserves total 985 bcm or 6.2 Gboe. If they could be fully recovered, they would sate the world's appetite for oil for just 1 month and natural gas for 4 months.

The combined annual production of 0.113 Gb of oil and 21.4 bcm (0.135 Gboe) of gas represents a mere 0.38% and 0.79% of global demand of 30 Gb and 17 Gboe respectively, totally overwhelmed by the anticipated growth in energy demand. The seemingly impressive production of 9.6 million tonnes (13 bcm when re-gasified) per annum of LNG represents only 1.7% of the combined North American network (US, Canadian and Mexican) gas demand of 566 million tonnes (775 bcm).

The discrepancy between the production of 21.4 bcm and the 13 bcm acquired in the re-gasified LNG illustrates the loss of energy involved in retrieving "stranded" gas, i.e. gas occurring remotely from the market. The 40% overall energy loss (supplied by 40% of the gas) is composed of a loss of around 10% in the processing facility, 15% in the compression needed to provide the friction loss in the pipeline and a further 15% loss in the purification prior to and including the liquefaction in the LNG plant. In the purification process impurities such as sulphur and carbon dioxide have to be washed out and the gas has then to be dried as otherwise the cryogenic liquefaction process getting it down to minus 160oC is impaired.

There are further losses on the tankship while underway to the import terminal. The LNG tanks on board are highly insulated, but are subject to a constant evaporation loss due to ingress of heat. Some of the gas is used to propel the ship by means of gas turbines, but the further the ship has to travel the greater the loss, which can be up to 5%.

The Sakhalin projects shows the economic mechanisms that apply as resources become more remote and difficult to retrieve. Oil and gas were once found relatively near the surface on the land on which the market developed, but now are only found after exhaustive exploration in deep water or in remote places with poor weather conditions.

The original Sakhalin 1 and 2 project costs together totalled US$ 16 billion, but are now expected to total around US$ 37 billion and may end up around US$40 billion. Apart from the transmission and processing losses resulting from the conversion to liquids, the capital costs of the projects can soar, not least because during the construction phase the fuel costs associated with the manufacture of components and the civil construction work on site are subject to constant escalation.

The value of the products is also subject to escalation, but unfortunately the developers have sold the production forward to customers associated with the investing countries. Once an oil or LNG tankship is on the high seas, its contents can be subject to barter for the best price and the original recipients can be disappointed if their own bid is exceeded. With forward selling by supply contract this advantage to the oil and gas supplier is surrendered.

The new cold war

The two projects are governed by production sharing agreements, which allow the consortia to recoup project costs before sharing the profits. Because of the escalation in the project costs the revenue payments to the Russian Natural Resource Ministry will presumably be delayed and in their aggregate reduced. They are somewhat miffed.

Sakhalin 1 is already supplying gas to the local market and oil is shortly due to arrive at the export terminal on the mainland. Also Rosneft has a 20% stake in the project, which will eventually benefit Russia. There are reports that Gazprom is wanting to acquire the Indian ONGC 20% stake, but this has been denied.

However, there is no Russian stake in Sakhalin 2 and the products are due to be exported. With the recovery of the excessive capital costs, there will be no benefit to the Russians for some time, neither in revenue nor in gas supplies, the latter having been sold forward.

To create a negotiating position, Russia has suspended the Sakhalin 2 environmental permits preventing the consortium from operating the project, which is 80% complete. It is likely that a deal allowing Gazprom to acquire a major part of the equity will result. This will mean that Shell's bank of reserves will be subject to further attrition.

Russian gas

It is assumed that Russia has limitless gas. This may well be the case, but the extraction of the same requires a huge capital investment as can be seen from the efforts of the two consortia in Sakhalin. The focus is now on the Shtokman gas field in the Barents Sea, which could not be in a more unpleasant and remote place, out of the reach of helicopters and within floating pack ice. The plans are to link this with a pipeline over Northern Russia to the North German coast laid on the Baltic Sea bed and to establish an LNG terminal at Murmansk, from which it could be exported.

But reserves are useless until they are exploited; what matters is the level of production and the cost of delivery to the market. From the BP Statistical Review 2006 , Russian oil production in 2005 was 3.48 Gb, whereas its domestic consumption was 29% of it (1.00 Gb). But the situation is more prescient with gas. Production in 2005 was 598 bcm (3.76 Gboe), while domestic consumption was 405 bcm (2.55 Gboe) amounting to 68% of it.

Russia has used its oil and gas earnings to pay off its debts and expects now to increase its domestic product. It begins from a low base, as a cursory inspection of this vast country away from the booming cities of St Petersburg and Moscow will show. Even a moderate rate of economic growth will mean that the demand for gas will soon take up the 50% margin over production existing at the moment.

Without foreign investment, the reserves of oil and gas production will not be exploited and, if there is investment, it will be because the investors want their return as energy supplies. It may also have occurred to President Putin that the UK, once a net exporter of oil and gas, is now a net importer. From where will Russia get its top-up gas when it is also a net importer?

By then the same investors that are digging up Sakhalin will have sucked the gas out of Qatar, Nigeria and Algeria. The Chinese are already taking gas from North-West Australia. The Indonesian gas that keeps the lights on in Japan is running out. Norway may provide a whiff of gas to Europe, but the Gazprom valves will have closed.

Energy Review

Tony Blair is complaining to Vladimir Putin about the hold up in the Sakhalin 2 project, but perhaps his own energy review has inspired Putin to perform his. As oil production passes its peak, there will be a natural tendency to move over to gas for liquid fuels. Due to the inherent inefficiencies in its transport from ever more remote and hostile locations, its use as a substitute for oil-based fuels and petrochemicals will cause it to deplete rapidly.

The whole world would like Russia's gas and will invest in projects to get it, but when it is gone they will not be around. Like Blair, Putin is resorting to nuclear power, but Russia is running down its uranium inventories and its indigenous mining production is in deficit. Maybe he has already decided to slow down the pace of gas exploitation while he considers the alternatives.

His erstwhile state farm employees have already taken their share of the communal land and live as subsistence farmers, keeping themselves warm with birch logs in the wood stove. They have already conducted their energy review.

- barrel = 42 US gallons = ca. 35 Imperial gallons = ca. 159 litres

- Gb = gigabarrels or billion barrels

- Gboe = gigabarrels oil equivalent.

- mcm = million cubic metres

- bcm = billion cubic metres