Nuclear power currently provides only 6% of the world's primary energy as heat, with 36%, 24% and 29% of it coming from the combustion of oil, natural gas and coal respectively. A MIT study estimated that in 2050 1500 MWe of nuclear electricity would be available but that will come at a time when only 10% of the oil, 15% of the gas and 35% of the coal will be left. As all three tail off to insignificance by the end of the century, to meet the world's anticipated energy needs beyond 2050, some 30,000 MWe of nuclear generation would be required, or 20 times the 1500 MWe specified by MIT. . . .

Perhaps because nuclear power stations are of an immense size an

illusion of great capacity is conveyed, leading to a mirage of

sufficiency. In reality there is no comparison with the great energy

content of fossil fuels. Nuclear power has no chance of replacing the

oil, gas and coal on which our daily lives depend, other than to a very

minor extent.

Introduction

The current status of the nuclear industry is that 439 nuclear power plants are in operation with a total net installed capacity of 372 GWe (gigawatts electrical). In 2007, they generated 2,608 TWh (terawatthours), which is 13.8% of total world generation of 18,895 TWh. There are 42 nuclear power plants under construction, while 5 are in long-term shutdown.

In 2007 in the UK, nuclear generation provided 57.5 TWh, which was 15.1% of the total UK generation of 380.4 TWh. The UK nuclear contribution will be somewhat less in 2008 due to the outage of many of the AGRs (Advanced Gas-cooled Reactors) owned by British Energy. All the AGRs are soon to be decommissioned; so, there is a plan to replace them by new build. The designs of two candidate reactors, viz. of Areva EPR and Westinghouse AP-1000, are under scrutiny by a Generic Design Assessment team (GDA) in studies expected to end in 2012.

The UK government is committed to encourage the private sector to build a new fleet of nuclear power stations and has declined to offer subsidies other than to bear the costs of a major nuclear disaster. It has also determined that the developers will be subject to a financial methodology that will ensure that the decommissioning and waste management costs will not fall on the taxpayer. This means that in addition to the need to raise the capital for the construction of the reactors, a considerable sum will have to be deposited up front to cover for possible equipment failure (limiting generation and the associated waste levy on revenue) or company liquidation.

If the proposed takeover of British Energy by the mostly state-owned French company Edf finally gets competition approval and is able to finance the deal, it is anticipated that four Areva Generation III+ EPR 1600 MWe (megawatts electrical) reactors will land on English shores, followed by another by E.On, a German utility. There is little likelihood of a private utility emerging with intention of building reactors to the alternative Westinghouse AP-1000 design, so if the GDA turns down the Areva EPR design it could lead to the abandonment of a UK new building programme.

Lest a sense of political inevitability clouds the vision of a better Britain reliant more on energy saving and renewable forms of energy, this overview will show the converse, that it is highly unlikely that nuclear power will enjoy a "renaissance" in other than corporate states like France, China and Russia.

MIT's "The Future of Nuclear Power" [1]

Five years ago in 2003, MIT published its report "The Future of Nuclear Power" "because it believed that this technology, despite the challenges it faces, is an important option for the US and the world to meet future energy needs without emitting CO2 and other atmospheric pollutants."

It did however recognise that there were other options, including increased efficiency, renewables and carbon capture and sequestration. It also recognised that it had to demonstrate better economics than those past to offset problems of safety, radioactive waste and proliferation risk.

It mused as to whether the public would place greater value on electricity generated with little CO2 emission, assuming that this would be small relative to the output of the overall fuel cycle. It accepted that there were "issues" facing nuclear power and considered means of overcoming them.

Five years later its conclusions are seldom cited; perhaps the projected 1500 MWe (megawatts electrical) of generation by 2050 based on an open "once-through" fuel cycle and, providing no more than 4% of the estimated global energy requirements at mid-century, was insufficiently inspiring for a world facing the end of an oil age. Also, maybe it is because the report ascribed a limited life to a technology which, without the "perpetual motion" of a fast breeder continuum, offers no more sustainability than the fossil fuels it is supposed to augment.

So, the current interest in returning to nuclear power was inspired not by the weighty, though somewhat flawed analysis of MIT's big brains, but by the skills of the public relations people. The campaign featured nuclear power as offering energy independence - even though 90% of the nuclear fuel for the US is imported and in the UK and in France all of its uranium is imported. Amid fears of global warming, it claimed that nuclear power emitted low, if not practically zero, carbon emissions.

Nuclear power currently provides only 6% of the world's primary energy as heat, with 36%, 24% and 29% of it coming from the combustion of oil, natural gas and coal respectively. [2] In 2050, when the 1500 MWe of nuclear electricity MIT proposed is to be available, only 10% of the oil, 15% of the gas and 35% of the coal will be left. As all three tail off to insignificance by the end of the century, to meet the world's anticipated energy needs beyond 2050, some 30,000 MWe of nuclear generation would be required, or 20 times the 1500 MWe specified by MIT.

If restricted to the "Once-Through" fuel cycle, the 1500 MWe generated would require primary natural uranium production of 306,000 metric tonnes per annum, whereas the total solution of 30,000 MWe would require 6 million tonnes of new uranium per annum. In 2007, the mining output was a mere 40,000 tonnes, somewhat less than that mined in 2005. There is absolutely no prospect of this rising seven-fold by 2050 to provide 300,000 tonnes per annum, let alone 6 million tonnes. The nuclear industry knows well that without a closed fast breeder fuel cycle it has no long term future, but instead persuades us that as the price of uranium rises, sufficient incentive will be given to the mining industry to raise the production of natural uranium accordingly. All the reactors under construction are of the "Once-Through" variety.

Perhaps because nuclear power stations are of an immense size an illusion of great capacity is conveyed, leading to a mirage of sufficiency. In reality there is no comparison with the great energy content of fossil fuels. Nuclear power has no chance of replacing the oil, gas and coal on which our daily lives depend, other than to a very minor extent.

MIT study findings

The study concluded that four critical problems had to be overcome for a large expansion of nuclear power.

Cost: to be cost competitive with natural gas or coal, carbon credits would be necessary.

Safety: the safety of the overall fuel cycle needs study.

Waste: geological disposal is feasible but is yet to be demonstrated.

Proliferation: The processing system in Europe, Japan and Russia that involves separation and recycling of plutonium presents unwarranted risks

Review of the findings

Cost: The most advanced of the Generation III+ series of nuclear reactors is the prototype Areva EPR 1600 MWe reactor. In Finland, it is already 3 years late and 50% over budget. Moreover, the role of carbon credits is proving complex. The industries emitting carbon, such as those with a coal-fired generating station, will in effect subsidise nuclear (assuming nuclear is re-categorised as non-emitting) and also genuinely carbon-free or carbon-neutral forms of generation. Generators with a mix of coal, wind and nuclear would be at least partially self-subsidising! Companies with just coal-fired boilers would be rapidly bankrupted as not only would their coal supplies be increasingly expensive (as the prices of all fuels relate to each other), but they would have to subsidise their nuclear competitors.

Safety: The EPR is reckoned to endure for 60 years, but there may be many unknown factors in a new design affecting safety, which may not be evident for many years. Irradiation progressively embrittles stainless steels, which in any case weaken at high temperatures. The EPR uses boric acid in solution in the reactor vessel as a moderator and this has corroded weld-metal around pipe entries. Following the exchange of vessel tops in around half of the EPR's predecessors in France, the weld metal employed has been changed, but only time will tell whether the problem is solved. In the case of the EPR, the equivalent vessel is merely lined with stainless steel and once the lining is penetrated the outer shell would rapidly corrode. In Finland, there were quality problems with the welding in of the liner, auguring badly for the planned life of the reactor.

The EPR employs fuel with a range of levels of enrichment, the highest of which has not been in service before and certainly not for the 60 years claimed for the operational life of the reactor. The safety implications are on the political pressure put on the safety inspectors to allow a continuation of operation when doubts as to the security of the containments are in question.

As example of this dilemma is the disintegration of the graphite moderator blocks in the UK AGRs. There comes a point when the debris fills the control rod channels in the blocks sufficient to prevent the adequate dropping of the rods to shutdown the reactor in an emergency. An adjacent temperature monitoring channel in the blocks can be inspected, but as to whether the reactor can be readily shutdown for safety reasons is then a matter of judgement.

The safety implications of a reactor have the greatest effect on the financial viability and the level of emissions in respect to the total generation, because if its life is curtailed on safety grounds, the 'return on capital' calculations are voided and the specific emissions rise inversely with the shortening of the operational life.

Waste: The "once-through" fuel cycle means that spent fuel spends around 10 years in a cooled pond, then is put into a dry cask and stored in a secure open-air compound, before it is finally placed in an underground repository.

Proliferation: MIT rejected recycling of spent fuel in fast breeder reactors and the associated waste processing on grounds of aiding nuclear weapon proliferation, so a breeder cycle was not studied. The report studied two varieties of closed loop cycles, but both were rejected.

Fuel cycles

MIT considered three fuel cycles, one open and two closed, though the latter are only partially so, all three needing fresh supplies of natural uranium.

The "Once-Through" fuel cycle requires for a generation of 1000 MW an annual feed of ca. 200 tonnes of natural uranium, leading to 20 tonnes of uranium in spent fuel and some 180 tonnes ends up in the enrichment tails.

The second of the three cycles considered is the recycled plutonium option in which plutonium is separated from the spent fuel and mixed with depleted uranium to form a mixed-oxide fuel (MOX). This means that the natural uranium requirement is reduced to 172 tonnes a year for the same generation, a reduction of only 14%.

The third of the three cycles considered splits the generation between a thermal reactor and a fast reactor, roughly half each. The use of this cycle would mean that the natural uranium requirement would be reduced to 111 tonnes a year for the same generation, with some 45% of the fuel recycled. However the capital costs of this option are high with the building of two fuel fabrication plants – one for uranium fuel and one for mixed oxide fuel - and two reactors, one thermal and one fast with the addition of a "pyroprocessing" plant.

The sustainability of nuclear power requires the fuel cycle to completely close with the inclusion of a fast breeder reactor to provide a nuclear "perpetual motion". In the breeder reactor, plutonium fuel "breeds" over 10 to 20 years the same amount of fuel as was originally charged. It is produced in a surrounding "blanket" of depleted uranium. In the cycle the plutonium produced is separated out of the blanket in a reprocessing plant, is passed to a fuel fabrication plant and then back in the fast reactor. The input to the cycle is the repeated charges of depleted uranium and the output is the waste and electricity.

MIT rejected the fast breeder just on proliferation grounds. It is a pity that it did not perform mathematical modelling of progressively introduced closed fuel cycles in a world fleet of "Once-Through" reactors, as it would no doubt have shown that the envisaged sustainability is a myth.

The "Once-Through" Reactor

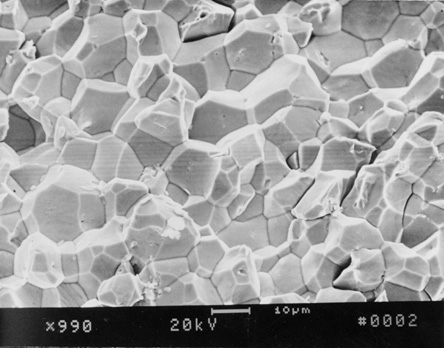

The "Once-Through" nuclear fuel cycle starts in the ground as natural uranium. In its natural state uranium contains only 0.7% of the fissionable isotope, U-235, while the bulk is the heavier U-238. The nuclear fuel placed in the reactor is the oxide of a suitably enriched uranium, from the original 0.7% to usually 3% up to 5% U-235.

MIT worked out that the natural uranium consumed during the build-up of its 1500 MWe fleet up to 2050 would amount to 9.5 million tonnes. Over the following 25 years, the subsequent decline in the numbers of reactors until they are all shutdown would mean that a further 7.5 million tonnes of uranium would be consumed. The total uranium consumption for its scenario is therefore 17 million tonnes. A rider to the adoption of the MIT scenario is that nuclear generation ends in 2075.

The "Once-Through" cycle assumes no reprocessing, so that for the requirements of the MIT scenario to be met, primary uranium mining will have to increase from its current rate of 40,000 tonnes to 306,000 tonnes per annum over the next 42 years.

So MIT highlighted a supply problem that needed to be addressed.

The disadvantages of the "Once-Through" cycle are evident,

hence the application of many nuclear scientists to the examination of

the closed cycle alternatives. But, erroneously, MIT concluded that

"resource utilisation is not a pressing reason for proceeding to

reprocessing and breeding for many years to come". In 2003, it

could not have anticipated that primary uranium mining would stagnate at

40,000 tonnes a year in 2007; but it should have known that the

US-Russian "Megatons to Megawatts" agreement, which keeps half

of the US nuclear sector fuelled, would terminate in 2013.

The disadvantages of the "Once-Through" cycle are evident,

hence the application of many nuclear scientists to the examination of

the closed cycle alternatives. But, erroneously, MIT concluded that

"resource utilisation is not a pressing reason for proceeding to

reprocessing and breeding for many years to come". In 2003, it

could not have anticipated that primary uranium mining would stagnate at

40,000 tonnes a year in 2007; but it should have known that the

US-Russian "Megatons to Megawatts" agreement, which keeps half

of the US nuclear sector fuelled, would terminate in 2013.

The MIT solution to the problem was to assume that rises in the uranium price would make the extraction of the bulk of the conventional resources occurring in low grades a viable proposition, arguing that the fuel is but a small part of the electricity cost makeup. It argued that a decrease in the ore grade by a factor of ten would increase the amount of available uranium by a factor of 300. It put great emphasis on the existence of large phosphate deposits, from which uranium could be extracted as a co-product. As the supply of uranium is crucial to an expanded nuclear sector it is considered below.

Apart from one fast breeder in Russia, the reactors under construction in the world are of the "Once-Through" fuel cycle. Only three countries have significant reprocessing ability, France, Japan and the UK. In the US, the embargo on reprocessing has been recently lifted, but apart from some experimentation with Generation IV types, the creation of a suitably-sized reprocessing sector for the global deployment of fast breeders is an unlikely prospect.

Uranium supply

The OECD/NEA and IAEA together produce a bi-annual "Red Book" which in its 2008 issue "identified the amount of conventional uranium resources to be about 5.5 million tonnes", while "undiscovered resources … have risen to 10.5 million tonnes". [3]

Even if this 16 million tonnes could be realised and would match the needs of MIT's scenario, the electrical generation therefrom would only provide around 4% of the world's forecasted energy requirement in 2050 and would thereafter be inadequate.

In fact, the actual primary uranium production of 40,000 tonnes of uranium meets only 60% of the current fleet's requirement of 64,600 tonnes per annum. The other 40% comes from the so-called secondary sources, comprising diluted ex-weapons highly enriched uranium, re-worked mine tailings, a modicum of mixed-oxide fuel (MOX) and inventories, which are coming to an end in 2013. [4]

The current production of 40,000 tonnes of natural uranium has stagnated for the past three years and has failed to match the projections of the "Red Book". There seems little chance that mining production will rise to meet the aspirations of the "nuclear renaissance".

Conventional uranium ores occur in a range of grades, the lowest now about to be mined being 0.014% at Trekkopje in Namibia, with the highest around 18% in mines in Canada. Some uranium is extracted from combined ores as a co-product with copper, gold and silver as in the Olympic Dam mine in South Australia.

Unconventional resources include the uranium present in phosphate rocks, but other potential sources are seawater and black shale.

MIT

put great emphasis on the existence of large phosphate deposits, which

with a uranium ore grade of 0.001% to 0.03% it concluded would hold 22

million tonnes of uranium. It failed to realise that at the lower grade

the production of 306,000 tonnes of uranium per annum would mean the

extraction and processing of 300 billion tonnes of ore, while even at

the higher grade this works out as a billion tonnes of ore. The input

energy required, mostly in the form of diesel for excavation machinery,

to shift these enormous quantities of rock would most likely exceed that

generated as electrical energy from the reactors supplied.

MIT

put great emphasis on the existence of large phosphate deposits, which

with a uranium ore grade of 0.001% to 0.03% it concluded would hold 22

million tonnes of uranium. It failed to realise that at the lower grade

the production of 306,000 tonnes of uranium per annum would mean the

extraction and processing of 300 billion tonnes of ore, while even at

the higher grade this works out as a billion tonnes of ore. The input

energy required, mostly in the form of diesel for excavation machinery,

to shift these enormous quantities of rock would most likely exceed that

generated as electrical energy from the reactors supplied.

As a co-product the uranium extracted depends on the rate of extraction of the phosphates. World production of phosphate rock in 2007 amounted to just under 150 million tonnes. Assuming an average recoverable content of 100 ppm an annual output of just 4,000 tonnes uranium per annum could be obtained. Morocco holds around 11 billion tonnes of phosphate rock, which is thought to contain 6 million tonnes of uranium, but at the current rate of production of 28 million tonnes, less than 2,000 tonnes a year of uranium could be extracted. In its desperation to find new uranium sources, Areva has signed an agreement with the Moroccan OCP to study the feasibility of uranium production from phosphoric acid. It could well be that around 6 EPRs could be fuelled from this source, but it is just a fraction of the 306,000 tonnes a year needed for the fleet envisaged by MIT. [5]

Areva's uranium supplies are in question as the commissioning of the Cigar Lake mine in Canada is delayed by flooding and it may well be abandoned, while the Olympic Dam expansion as an open pit in South Australia is dogged by high capital costs including the cost of the diesel needed to shift the overburden over a five-year period. BHP Billiton, the owners, will initially export the co-product uranium as a contaminant in copper concentrate for separation by the recipient. [6] In India in 2008, many nuclear plants are be running at half output due to a shortage of uranium and this may be the case in many other countries in following years.

As an interesting aside, Areva has obtained a contract for the supply of two EPRs to China on the pre-requisite that 35% of the uranium production from its newly acquired Trekkopje mine in Namibia will be destined for China. The mine has the lowest ore grade yet to be mined (0.014%), is open pit and will rely on an alkaline heap leaching method, whereas most use an acid. It is unlikely to remain open for more than 9 years of the 60 year operating life claimed for the EPRs. It contrasts markedly with the Cigar Lake mine in which it has a stake in Canada, where uranium ore of the highest grade of 18% is inaccessible due to catastrophic flooding.

It may well be that in the interim further mines will be opened, while many obsolete nuclear plants will close, relieving the uranium demand, but the contribution of more than a few percent of the world's energy requirements in the next few decades by means of the "Once-Through" nuclear reactor fuel cycle is an unlikely prospect.

Waste stream

The extraction of uranium and its subsequent processing produces several waste streams. At the average ore grade of 0.15%, the extraction and processing in of the world's current annual demand of 63,600 tonnes of natural uranium, leads to the arising of 42 million tonnes of mill tailings, converting it to UF6 gas leads to 42,000 tonnes of solid wastes and 39,000 m3 of liquid waste. The enrichment process leads to 77,000 tonnes of depleted UF6 while the fuel fabrication plant leads to 4,000 m3 of solid waste and 68,000 m3 of liquid waste, while 9,000 tonnes of spent fuel ends up in the ponds. The 1500 MWe of nuclear generation envisaged by MIT in 2050 would create annual waste streams five times the above.

The "Once-Through" nuclear fuel cycle extends over more than a century, so perhaps its worst feature is that the final waste arises after the envisaged operational life of 60 years, so that no one engaged in the present building programme will still be working in the industry (or politics) when the last spent fuel is placed in the pond. Also the spent fuel will reside in the ponds for at least ten years after the last plant is closed at the end of its life. Thereafter the fuel elements will need to be placed in dry casks and then transported to the final repositories, if they ever get built.

There needs, therefore, to be an available and usable source of energy at the turn of the century to ensure that the ponds remain filtered, circulated through a cooling system and the level of water adequately covers the elements. Otherwise, if a pond dries out, the elements will catch fire and melt down. The energy supplies at the turn of the century are of a somewhat uncertain nature. Oil and gas will have virtually gone, while there may be a modicum of coal. It is proposed that the stations will have standby diesel generators, but will an adequate supply of diesel be able to be put by in tanks until required? It may be subject to bacterial attack. Perhaps the best solution would be to build a small coal-fired station with a supply of coal for say 30 years of running stacked nearby. There will be some wind and other renewable forms of power, but they will be at a premium. There does not seem to be a solution to a problem likely to arise from say 2050 to 2100 and beyond that can be defined at the initial project stage.

For the moment it is a minimum requirement that sufficient space is left at the station sites for adequate pond storage and for a secure area so that the dry casks can be stored outdoors. The secure areas need to be allocated when the site plan is drawn up and they need to be well inside the plant boundaries for guarding purposes. The UK government has stated that they will require a satisfactory methodology for waste treatment before the new build plans are authorised. The Environment Agency has provisionally assumed that adequate energy will be available at the end of the century for the purpose, without stipulating its source.

Valedictory conclusion

Arguments as to the merits of nuclear power have raged for the five years which has elapsed since the publication of MIT's "The Future of Nuclear Power". With so much attention being paid to climate change, the examination of the specific carbon emissions over the nuclear fuel cycle has featured. The safety of various designs of nuclear power plants has also been much debated. The economics of the fuel cycle have been studied by many and the general conclusion is that it is only viable with a cash credit from the sale of carbon permits to the polluting industries. This is why the claim of nuclear's virtually zero carbon emissions have been so hotly debated, since this property enables the carbon credits to be applied.

However,

the most significant threat to its long-term survival is the shortage of

uranium, unable to be relieved by the introduction of sufficient closed

cycles even if such were available. Of no lesser significance is the

capacity of the manufacturing and construction industry to be able to

supply and build to even the most limited of programmes. While the

capital costs of the prototype Areva EPR in Finland soar and delays set

in, its commissioning in 2012 is quite likely to be further delayed.

However,

the most significant threat to its long-term survival is the shortage of

uranium, unable to be relieved by the introduction of sufficient closed

cycles even if such were available. Of no lesser significance is the

capacity of the manufacturing and construction industry to be able to

supply and build to even the most limited of programmes. While the

capital costs of the prototype Areva EPR in Finland soar and delays set

in, its commissioning in 2012 is quite likely to be further delayed.

Although denying any potential shortage of fuel, EdF the French state-owned utility has opted for the building of gas-fired stations in the UK if it acquires the sites of British Energy and the Nuclear Decommissioning Authority (NDA), at least as an interim measure.

This statement, largely unreported, may have signalled that the French at least know that although several new nuclear power stations may well be built in China and Russia, the aspirations of so many countries, including many oil-producing states and even chaotic states (like Nigeria and the Philippines) that would like a nuclear sector will not be met.

La renaissance est avorté.

[1] "The

Future of Nuclear Power".

[2] BP

Statistical Review 2008.

[3] Red

Book.

[4] Red Face Book.

[5] The big hole,

[6] An Even Bigger Hole .